Open Banking is predicted to reach 600 million users by 2030. Will your payments strategy meet the moment?

OneBanx, a GLORY Company, is a mobile-first Payment Orchestration Platform that unlocks the potential for enhanced engagement and revenue streams beyond traditional ATM networks.

A Payment Platform Enabling Access to Key Cash Services

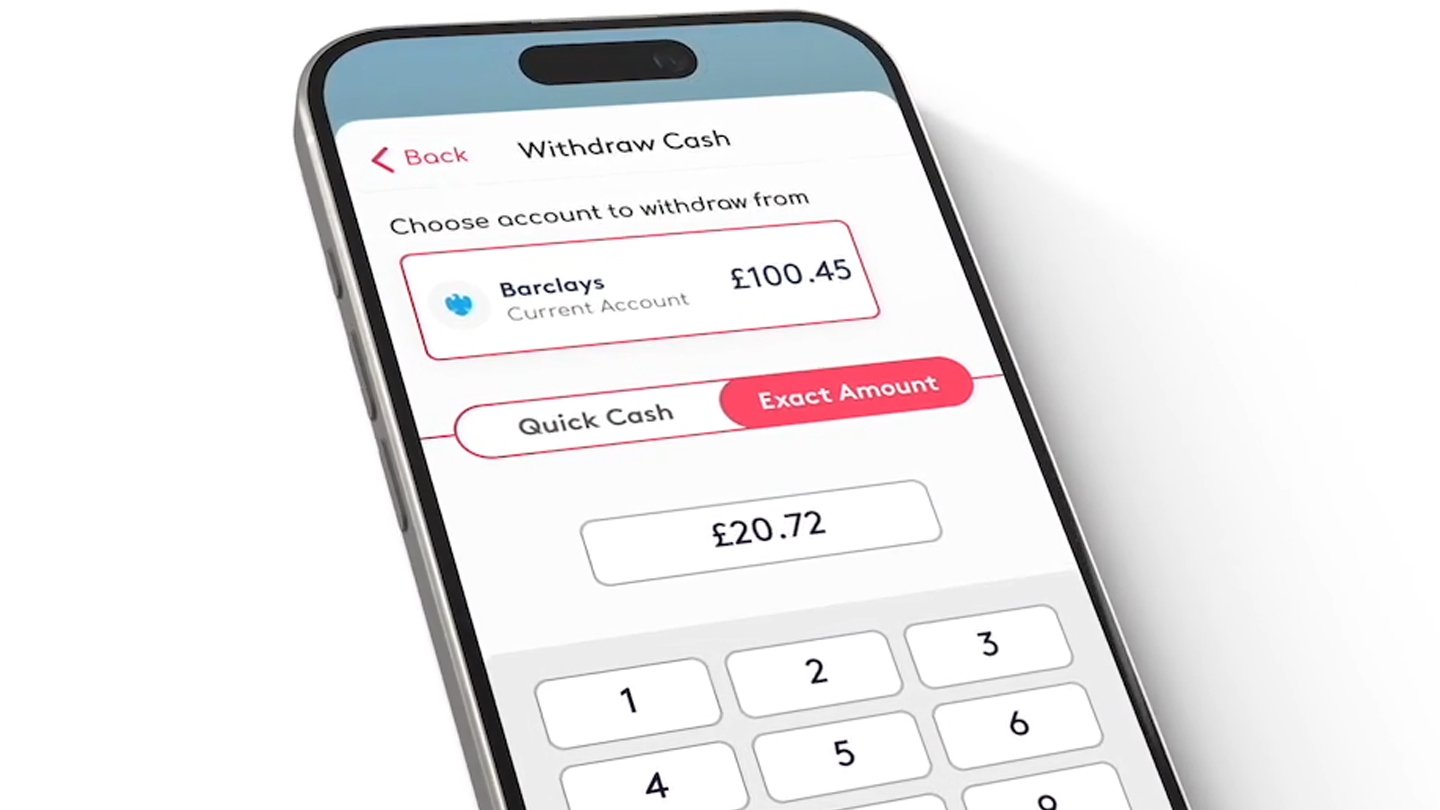

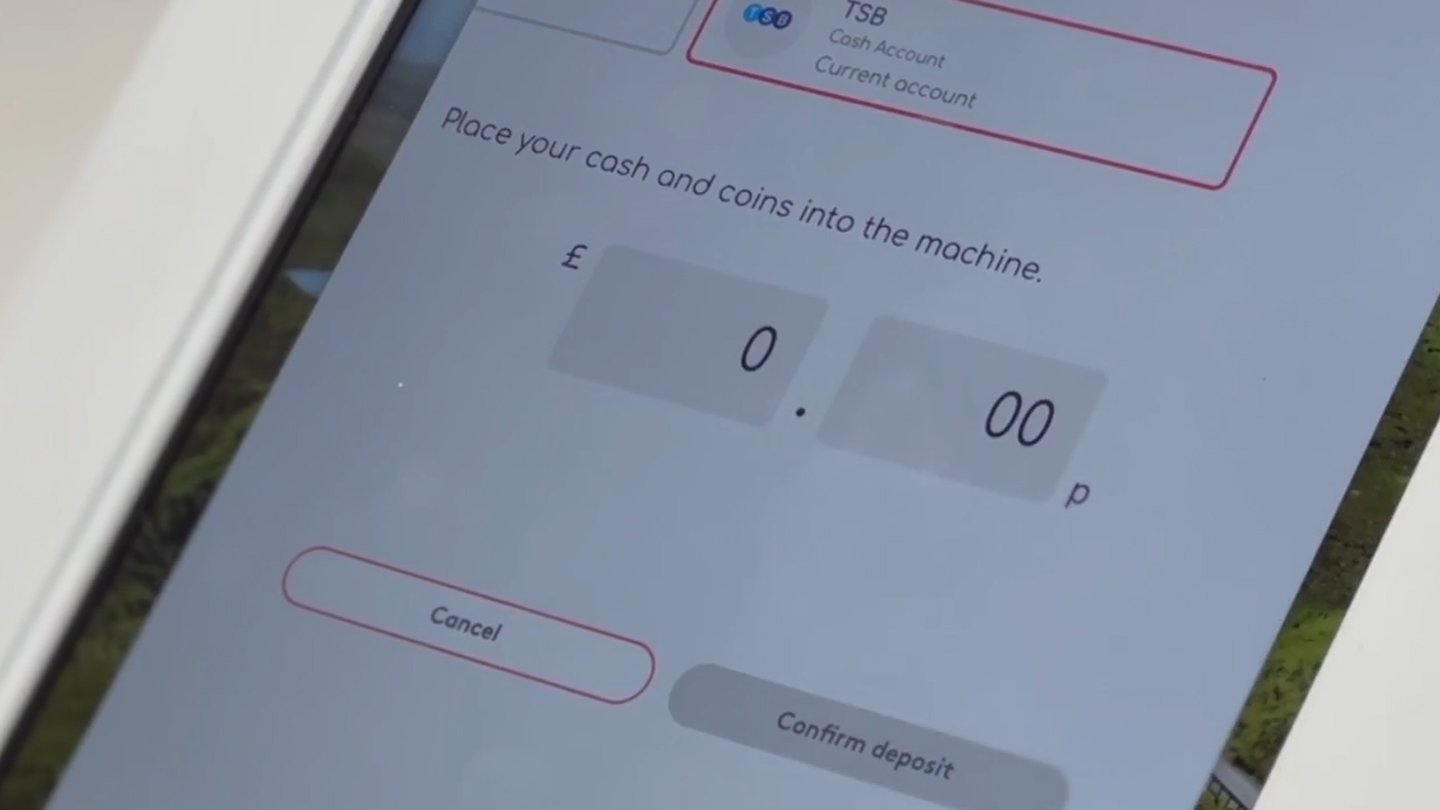

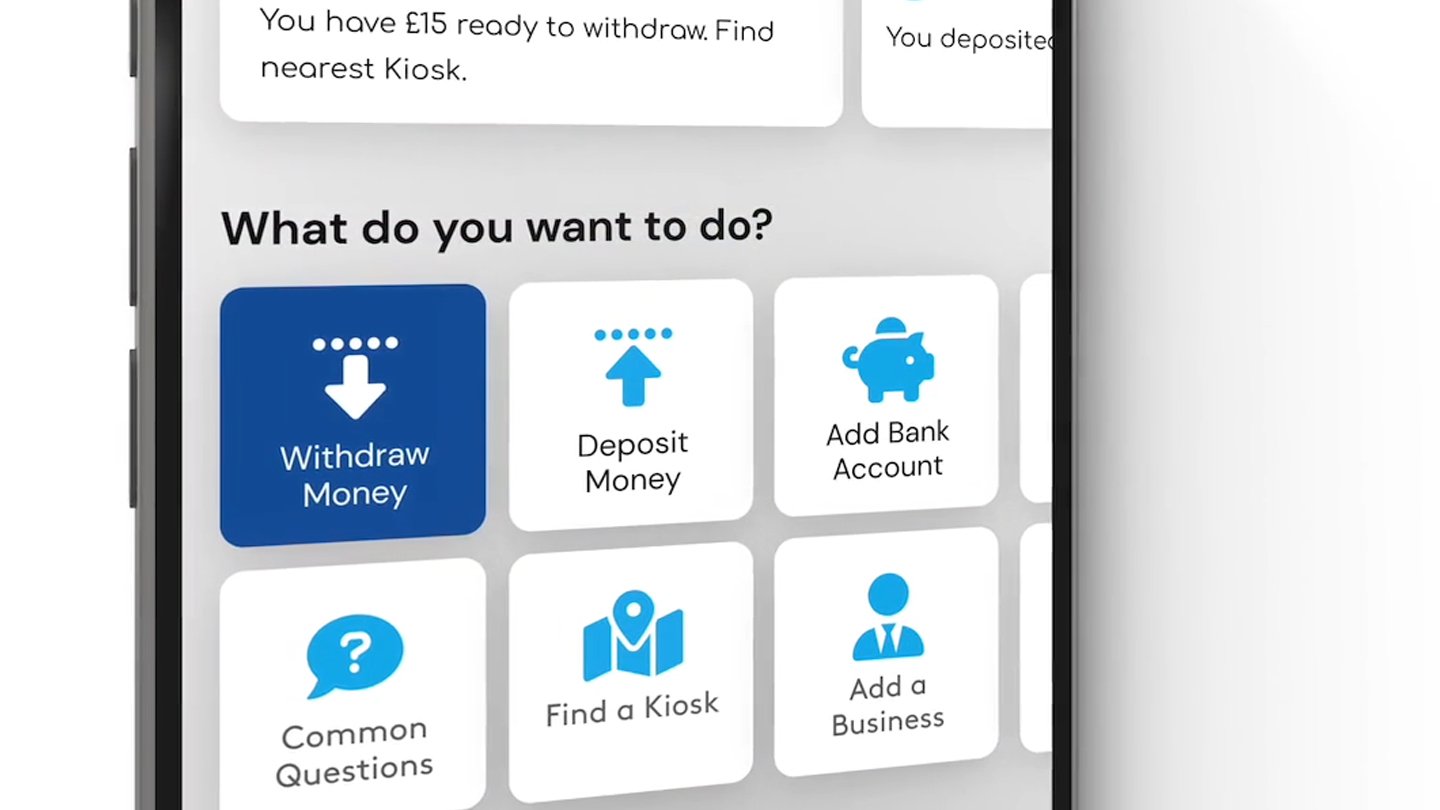

OneBanx’ unique solution leverages Open Banking protocols combined with Glory Recycler technology to deliver real-time cash withdrawal, deposit and change services where it’s needed, extending a seamless digital experience into the physical world of cash via an app-based interface.

Revolutionise the business deposit experience.

Businesses can enjoy the power of real-time cash and coin deposits and withdrawals with instant account crediting—no delays, no guesswork. Pre-ordered change is prepared and ready exactly when you need it, eliminating downtime and improving cash flow predictability.

Businesses can empower their teams by delegating deposits to trusted employees, freeing up valuable time and allowing business owners to stay focused on what matters most: running and growing their operations.

Agent-assisted onboarding is fast, simple, and only a phone call away.

Enhance your Brand Services or Create new revenue streams? Your choice.

Prefer to reserve the service for your brand customers only? Or want to enable access for other brand customers to unlock new shared-service revenue streams.

Thanks to OneBanx’ unique Open Banking platform, you can instantly offer cash services for customers of any UK bank brand at a OneBanx-enabled service location in addition to your own.

Compliance

The modern digital payments infrastructure demands real-time oversight, to limit financial exposure and comply with regulatory responsibilities.

OneBanx’ takes care of KYC and AML on your behalf, so that your teams can focus on managing the ever shifting landscape outside of cash transactions. As banks shift to digital-first models, OneBanx preserves access to essential services while supporting innovation through a regulation-friendly, infrastructure-light approach.

Benefits of the OneBanx solution

OneBanx pioneers a unique platform harnessing Open Banking capabilities through various kiosk formats.

High Street Banks

OneBanx offers a multi-bank, Open Banking-enabled platform for fast deployment and easy access to accounts across nearly all UK high street banks—without complex integration. Our fully managed solution includes compliance safeguards and Glory’s cash recycling technology for efficient note and coin handling.

Beyond individual account access, we enable automated business transactions, including instant credits and pre-ordered change pickup. Merchants can delegate deposits to trusted staff, saving time and boosting focus.

OneBanx expands your institution’s reach in-branch or off-premise, delivering a modern, mobile-led experience that’s customisable and brandable.

Community Banking Institutions

For Community Banking Institutions

At OneBanx, we understand the vital role building societies play—delivering essential financial services, supporting homeownership, and driving local development. As you uplift your communities, OneBanx uplifts you with a fully managed service, including online support, and tailored installation. Our technology enables cost-effective digital transformation.

Leveraging Open Banking, OneBanx helps you maximize physical investments, expand community impact, attract new members, and support local businesses with accessible banking.

Join the growing network of building societies committed to keeping cash flowing locally and enhancing their brand with the OneBanx solution.

Postal Operators

OneBanx enables postal operators to expand their roles as trusted community hubs by offering essential banking services—boosting relevance in underserved areas. The platform integrates with existing POS and kiosk systems to support instant deposits, withdrawals, and Open Banking payments for customers of nearly all UK banks—without costly infrastructure.

Consumers and small businesses manage cash securely via the mobile app with biometric ID, increasing footfall, engagement, and revenue. Transactions run through the Faster Payments rails with full traceability and compliance, supporting financial inclusion. Partnering with OneBanx helps post offices deliver modern, secure banking—transforming each location into a gateway to the future.

For Retailers

OneBanx helps retailers offer essential banking services at the point of sale, turning stores into convenient hubs for cash deposits and withdrawals. Integration with existing POS or kiosks attracts new footfall and supports financial access in underserved areas.

Customers manage cash securely via the mobile app and biometric ID, combining shopping with banking. Retailers join a nation-wide network serving nearly all UK banks—without core banking integration. This opens new revenue, builds loyalty, and supports financial inclusion. OneBanx provides a low-cost, modern way to deliver secure financial services—making every store a trusted access point.

OneBanx and the benefits of shared banking

Speed. No integration required

Modern, Flexible Payment Platform

Deliver Key Cash services on-premise or via shared-infrastructure. OneBanx is designed to enable your next generation Distributed Service strategy.

Instant Payments Mean Instant Availability

Fully KYC and AML Compliant

Digitized Customer Journeys

No card? No problem.