BANKING

Deliver Confidence in Every Branch Interaction

Free up your team to deliver exceptional customer interactions at every touchpoint while our automated solutions handle cash securely and reliably across branches.

Reimagine Branch Banking

Branch banking is at a critical inflection point. As digital channels continue to grow, traditional branch models—with their high costs and inflexible structures—struggle to meet modern customer expectations. To stay relevant, branches must evolve into tech-enabled, multi-format hubs. GLORY empowers this transformation with adaptable technology that supports advisory-led experiences and redefines the role of the modern teller.

Image

Modern Banking Demands Trust at Every Turn

Customers want a seamless, anytime-anywhere banking experience they can trust. But meeting those expectations securely and efficiently isn’t always simple.

Experience the benefits of GLORY’s banking technology

Flexible Branch Models that Build Confidence

Your branches need to deliver consistent, secure experiences — whether it's a full-service location or a mall kiosk. Our technology adapts to your exact needs while maintaining the trust your customers expect.

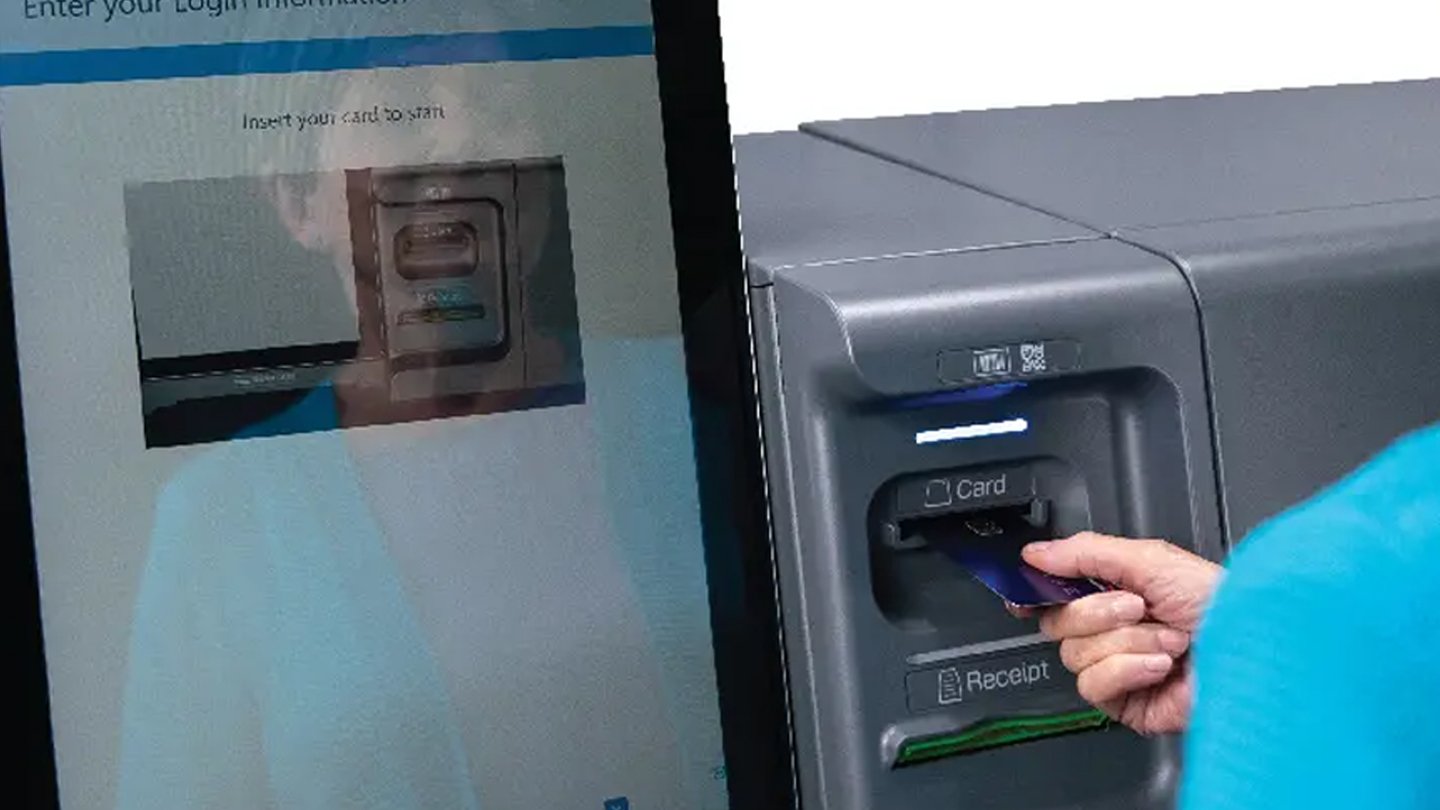

GLR-100: Banking Automation that Builds Customer Trust

The GLR-100 combines secure cash handling with intuitive self-service technology to help financial institutions deliver consistent, reliable service while reducing operational costs.

Designed for both staff and customer ease of use, the GLR-100 processes transactions quickly and accurately — whether it's deposits, withdrawals, or account services. Its security features protect every transaction, while its interface ensures customer confidence at every step.

Software that Makes Banking Better

GLORY’s software solutions help you serve customers faster, keep your systems running smoothly, and make smarter decisions with your data.

DYNAMIX

Make every banking transaction intuitive—for both customers and staff. Seamless integration with your bank’s existing systems, adapting to how you work while enhancing user experience.

Business intelligence with UBIQULAR™ Inform

View, compare, and analyse cash processing data from all your cash handling devices.

UBIQULAR Bridge: Your Branch Control Center

Think of UBIQULAR Bridge as your network’s early warning system and control room combined.

OneBanx: Redefining Banking Access for Modern Businesses

OneBanx, a GLORY Company, is redefining cash management for businesses. Our Open Banking-powered platform allows secure, instant deposits, all in high-traffic locations like shopping malls. With the flexibility to support a range of providers and meet diverse customer needs, OneBanx is setting a new standard for how businesses manage cash in a world where speed, trust, and simplicity are everything.

Why Glory?

At GLORY, we understand that your customers need more than just banking products — they need a partner who helps them manage operations efficiently, securely, and reliably with confidence. That’s why our solutions are designed to address the core needs of both your business and your customers, ensuring smooth operations and building trust every step of the way.

100+

countries,

millions served

7%

of revenue

invested in R&D

1200+

researchers

& engineers

Start Your Journey to

Smarter Banking