Generation Z and Cash: Is Physical Money a Thing of the Past?

Cleopatra Mavredis

GENERATION Z AND CASH: IS PHYSICAL MONEY A THING OF THE PAST?

If I only had a euro (or a pound if you’re in the UK), for each and every time I heard that question!

As a Baby Boomer, having a few banknotes in my wallet is a must, but does Gen Z (the “Zoomers”, 1997-2012), our next generation workforce, think the same way?

If you're Gen Z, chances are it's been a while since you paid for something with cash, and very possible that you don’t even carry a physical wallet. Digital wallets and instant payment providers such as Venmo, Apple Pay, and even digital credit cards are winning, hands down.

As Gen Z (and the generations that follow) increasingly embrace digital payments, will cash become extinct?

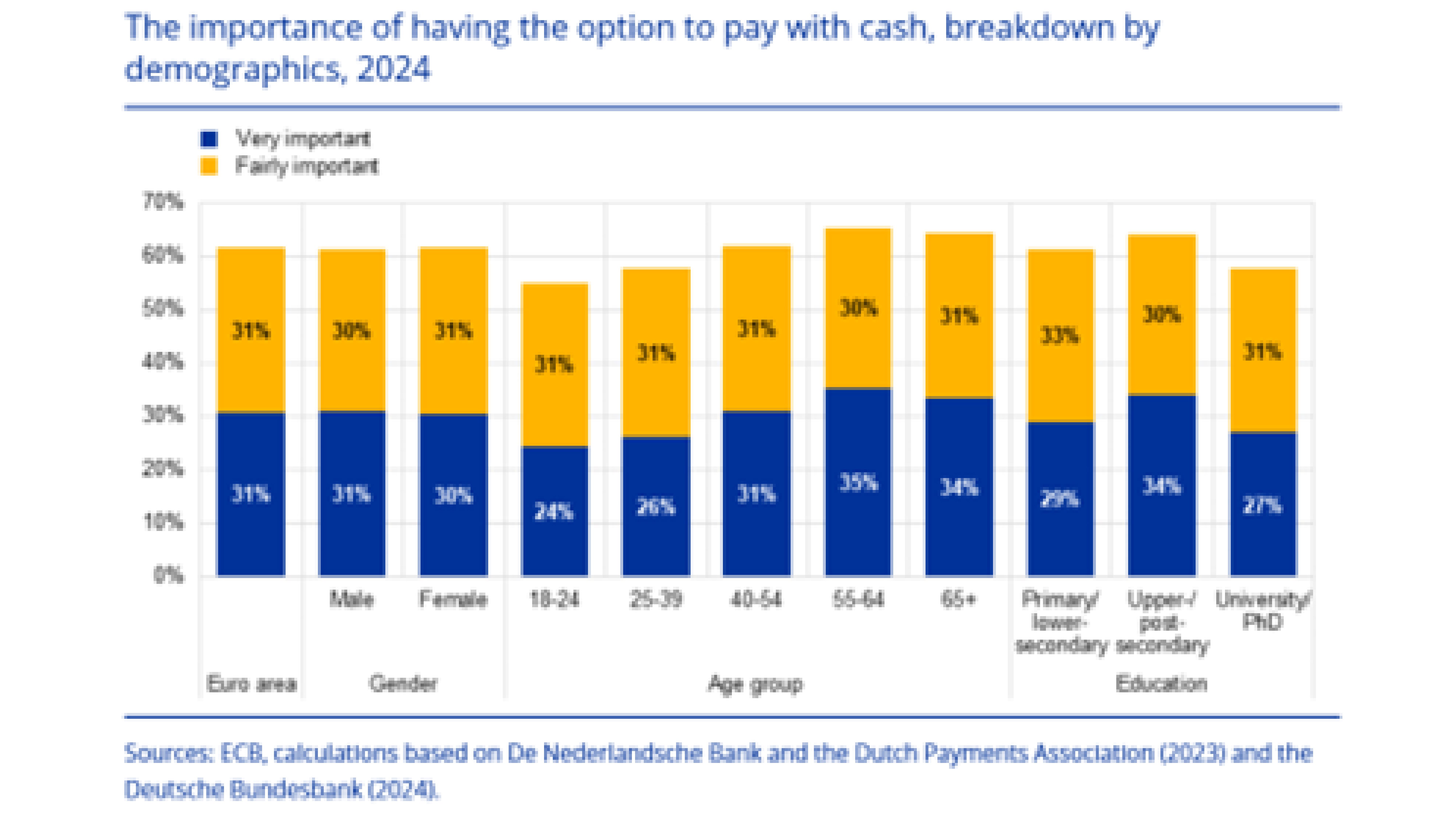

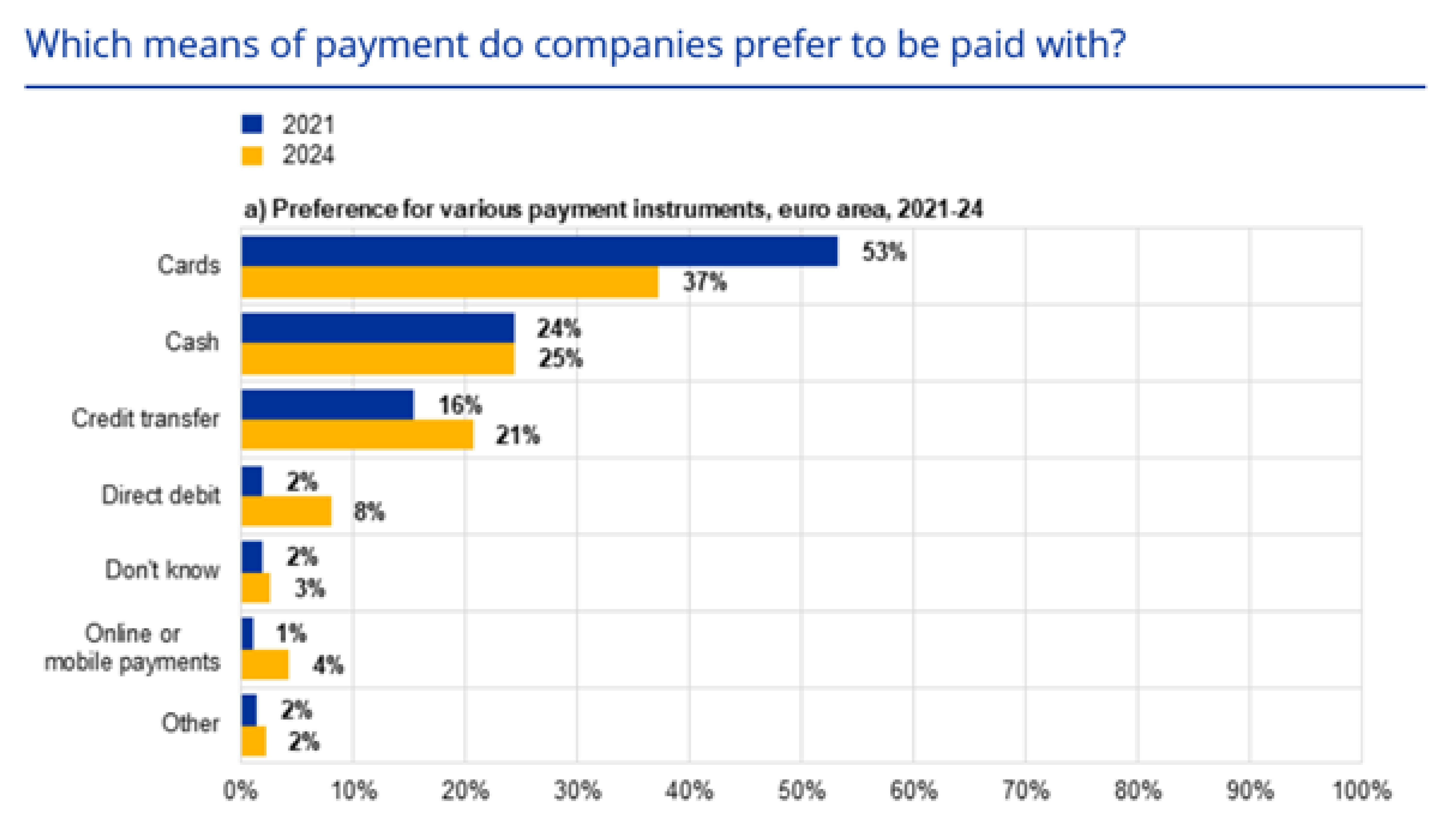

As a matter of fact, in the recent European Central Bank (ECB) 2024 report on cash acceptance, Gen Z patrons are no different than Baby Boomers in their attitude towards cash, as can be seen from the chart below. With cash still ranking #1 as the most accepted means of payment, followed by cards and credit transfers, it is for this reason that providing consumers with the option to pay with cash is the right approach.

With a cashless system, technical glitches and system failures can leave consumers stranded, whether it’s buying a cup of coffee or having to make a payment in an emergency situation. Cash is always the safest backup when digital systems fail.

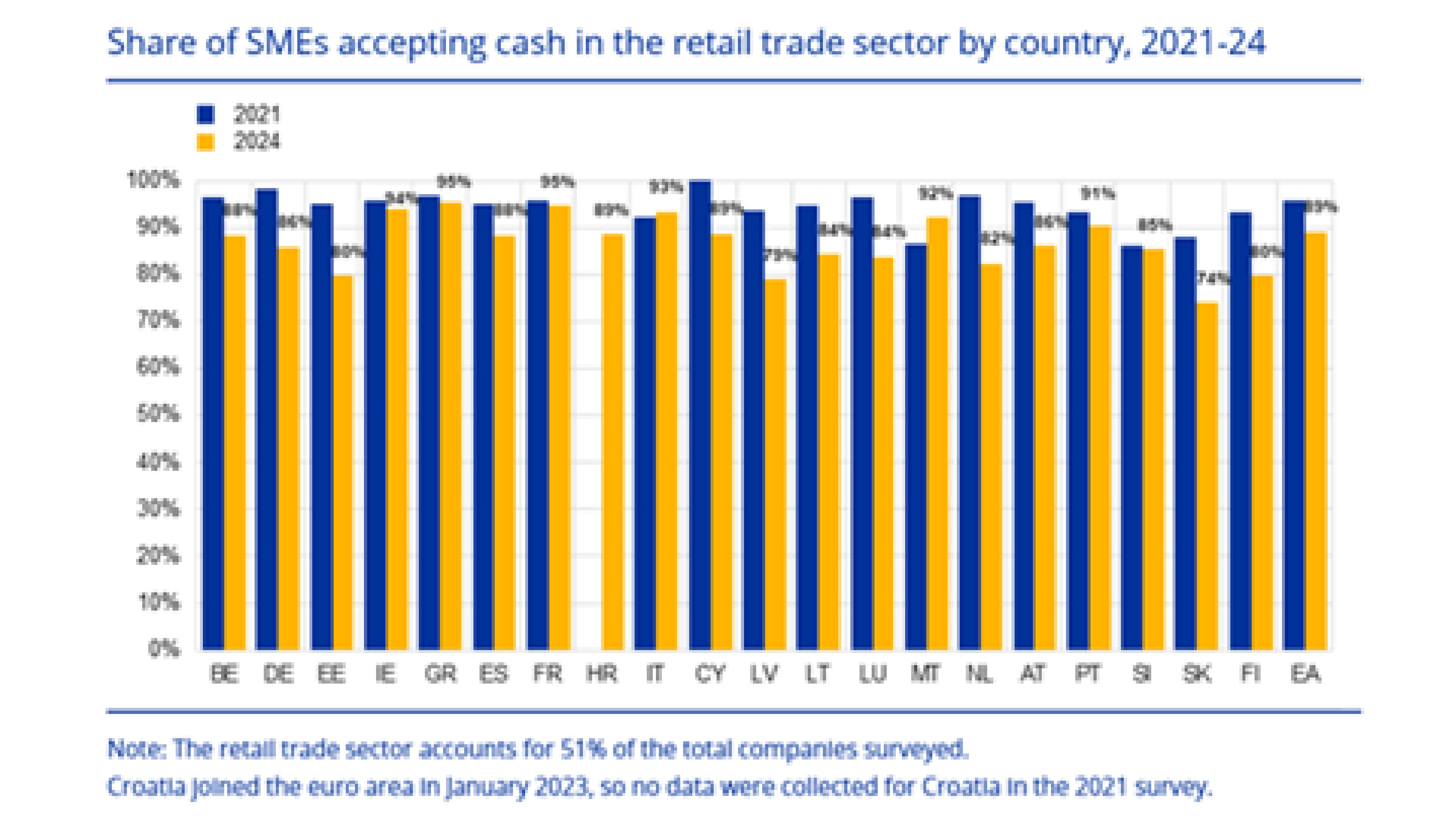

Industry experts around the world say that cash may ultimately disappear, but predictions for when that might happen are still very varied. Even when cash usage is viewed from a demographics perspective, age range, or even industry sector, the ECB survey clearly shows that cash decline is relatively marginal compared to three years ago.

An independent Irish survey revealed that despite the growing adoption of digital payments, cash remains a preferred payment method for many consumers, particularly among younger generations. The nationally representative survey, conducted by Empathy for An Post, Ireland’s postal service provider, found that nearly three in ten adults (28%) use cash at least once a day, with a further one in ten using it 4 to 6 times a week. The research went on to cite, “Despite the rise of contactless payments through mobile wallets, young adults aged 18-24 are the biggest users of cash, with 35% reporting that they use cash daily. In comparison, just 26% of those aged 35-44 use cash on a daily basis, indicating a higher adoption of digital payment methods in this group. Only 2% of respondents claimed to never use cash.”

Why not ride the cash wave and ensure a balance of both digital and physical?

With cash still very much alive and kicking according to the ECB 2024 report, which shows that regardless of generation, country, industry sector, and other demographics, there still remains a wide and continued requirement for cash.

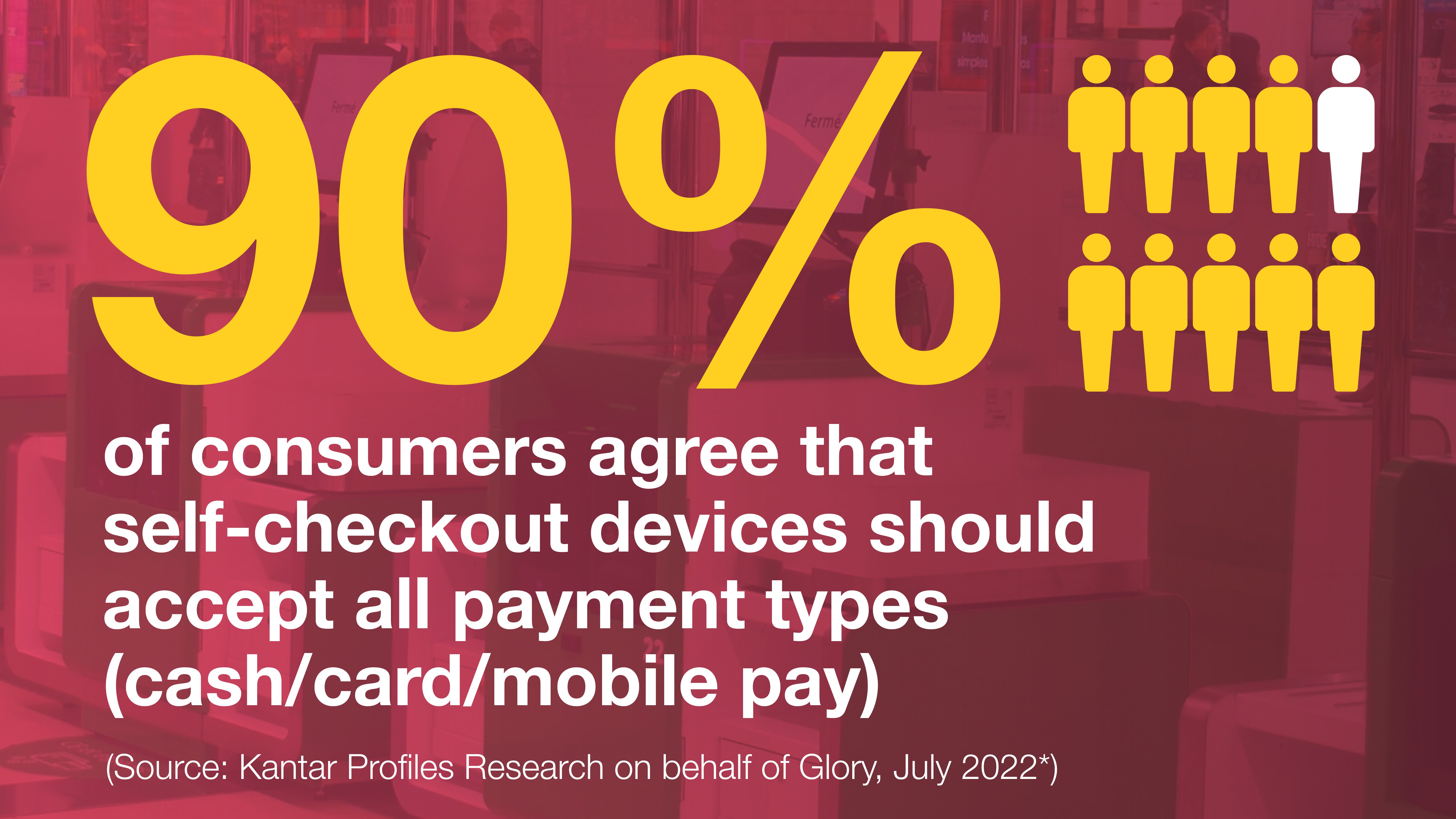

To support our corporate strategy, Glory commissioned KANTAR to conduct a study on self-checkout (SCO) acceptance. The study revealed that 80% of consumers consider it important for retailers to provide a choice of checkout options, and 90% believe that SCOs should accept all payment types.

Customers have told us that having the flexibility to access multiple payment options is an all-around better consumer experience.

The growth of self-service kiosks in quick service restaurants has been embraced by consumers because they can avoid long queues simply by ordering and paying autonomously. Even the growth of SCO in railway and underground stations, parking totems, as well as casinos, is also seeing a strong need to support cash payment options. This once again confirms the abundance of cash in many societies, regardless of the generation.

We know that cash recyclers are able to verify, accept, and process cash payments or deposits without human intervention. The ease of integration with self-service has proven to be widely accepted by both consumer and staff alike. Not only do cash acceptance devices save staff time and reduce cash shortages, but they also play an important role in the ability to reduce Cash-In-Transit visits.

Wouldn’t it make sense to focus on creating efficiencies throughout the cash distribution cycle?

Through the many tangible benefits associated with cash automation technology, there is value in re-visiting the cash distribution process from both a business as well as user-experience perspective, looking at key topics such as:

Financial Inclusion: Many people still rely on cash, and these technologies help them transition to digital finance.

Security and Fraud Prevention: Cash automation uses currency templates to detect suspect banknotes, reducing fraud risks.

Business Efficiency: Automating cash handling reduces errors, labour costs, and shortages.

Consumer Choice: Businesses embracing cash automation can do so easily in symbiosis with digital payment schemes.

We have learned that Gen Z still like cash!

Bridging the gap between physical and digital payment choices is likely the safest approach for the next 20-30 years, at least. Cash is far from obsolete, and introducing cash automation technology will help to ensure cash acceptance for all generations, past, present, and future.

Resources:

European Central Bank. (2024) ’Use of cash by companies in the euro area’, 18 September. Available at: https://www.ecb.europa.eu/press/use-of-cash/html/ecb.uccea202409.en.html#toc1.

The Reputations Agency. (2024) ‘18-24 year olds are the highest users of cash in Ireland’, 19 November. Available at: https://thereputationsagency.ie/latest/news-and-thinking/2024/11/19/18-24-year-olds-are-the-highest-users-of-cash-in-ireland#:~:text=The nationally representative survey, conducted,to 6 times a week.

Never miss the latest blog