Reducing the cost of cash. Hear retailers’ voices on the 5 key benefits of the Clip shared cash deposit network.

Managing cash deposits can be something of a hidden cost, just a routine part of the business day that is rarely scrutinized. But how far do you have to travel to deposit your cash? How much time and energy are drained from your operation, just on journeys back and forth to the bank every week, month and year?

Today, new technology and shared service networks are revolutionising businesses, bringing new efficiency and dedicated expertise to many aspects of commerce – and cash deposits are no exception.

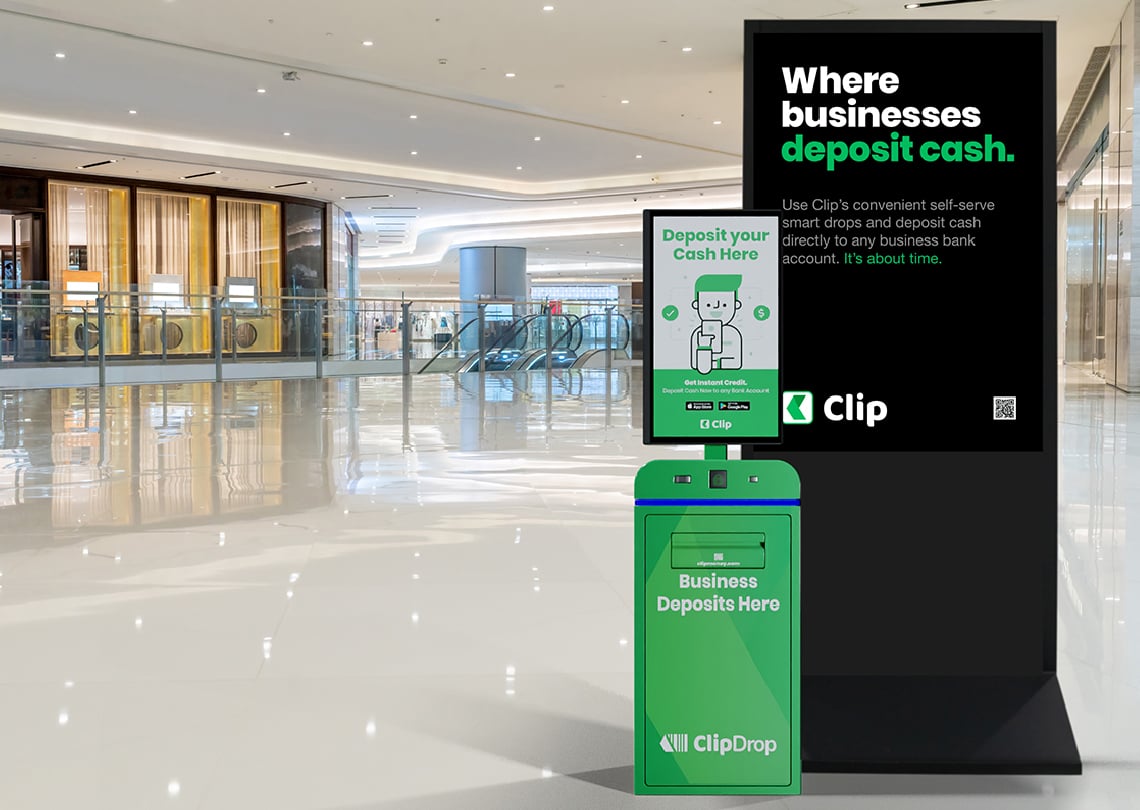

Clip is a first of its kind, shared deposit network developed to make business cash deposits easier, more convenient and cost effective. Featuring IoT enabled deposit boxes, a mobile-first software platform, and robust reporting and metrics, Clip’s deposit boxes can be deployed in convenient locations such as shopping malls and large retail stores, allowing retailers to manage cash deposits right on their doorstep.

Let’s hear directly from retailers on how they are benefiting from shared deposit services:

1. Time Savings

Perhaps the most impactful benefit of the shared deposit network is the time saved traveling to and from the branch to make cash deposits. “Our experience so far has been fantastic. The location is very convenient,” says Andy Espinola, franchisee and manager of Harvey’s, Canada’s oldest and largest full-service restaurant franchise. “We used to travel 30+ kilometers to the bank just to deposit money. It made life much simpler for our managers to do a daily deposit.”

2. Cost Savings

Whether it’s through eliminating the need for CIT services, or just the labour time spent for your employees to drive to the bank, Clip can lower costs for your retail business. Austin Harrison, Franchise Owner at Chick-Fil-A Yorkdale, sees Clip as “the cash solution of the future.” Harrison adds, “Clip Money provides an incredible product in an industry where technology is lagging, and cash couriers are unreliable. We’ve actually saved money switching!”

3. Efficiency and Security

As the manager of retail operations at Matt & Nat, Tarun Kohli appreciates the efficiencies that Clip’s shared deposit network offers their growing network of stores. “We have been able to streamline our cash management across multiple stores and consolidate banking relationships.” The strategic placement of the network also brings the benefit of added convenience and security of in-mall locations. “Our managers deposit when it's convenient in the comfort and safety of the mall without having to go to the bank.”

4. Streamlining Operations

Shared deposit services allow businesses to outsource the management of business cash deposits to specialists who focus their expertise on delivering this solution. Brogan Butz, Cash Management Manager at Lids agrees: "Clip enables our stores and head office team to streamline cash operations with visibility and accountability throughout the entire deposit process in real-time, while significantly reducing direct and indirect costs. Now our store managers and employees can focus more on our valued Lids customers.”

5. Accountability and Transparency

Another benefit of Clip’s mobile-first platform is that it enables a robust user management system and supports a dashboard that offers granular insights and analytics. "We chose to expand our partnership with Clip after two successful holiday photo seasons,” said Liz Scoropanos, Vice President, Retail Operations of Cherry Hill Programs. “Clip has made our onsite operations more efficient and effective, while providing a high level of accountability and transparency." Scoropanos went on to say that “Providing Cherry Hill Programs’ leadership team with real-time visibility into transaction history has been extremely impactful to our operations.”

As these retailers have demonstrated, shared cash deposit services can greatly benefit those seeking reduced cost, increased operational efficiency, and more visibility in their cash management. And banks that offer these services to their commercial customers help their customers realise these advantages, and in the process enjoy cost-savings, operational efficiency, and improved customer satisfaction for themselves.

Learn more about Clip and the benefits of a shared cash deposit service here, or get in touch using the form below to have an informal chat with one of our team.